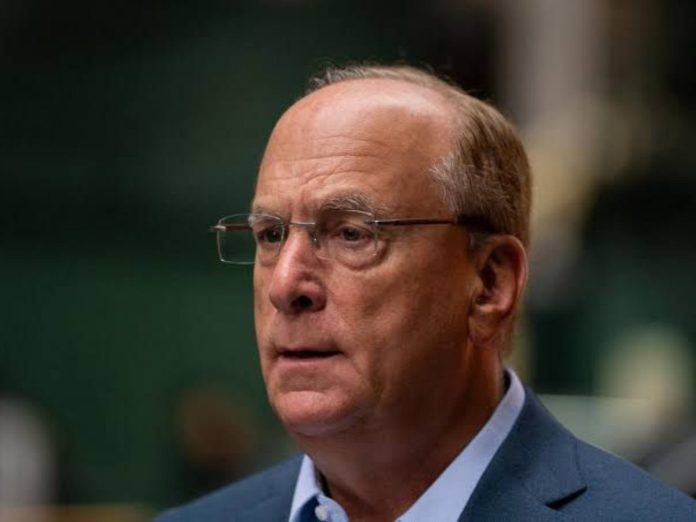

Larry Fink: The Unseen Hand Guiding Global Finance

In the vast universe of global finance, certain names resonate with immense power and influence, even if they don't always grace the covers of celebrity magazines. While figures like Elon Musk, Jeff Bezos, or Bill Gates dominate headlines with their innovations and personal brands, there's a quieter, yet profoundly impactful individual shaping the very bedrock of the world economy: Laurence "Larry" Fink. As the founder, CEO, and Chairman of BlackRock, the world's largest asset manager, Fink holds the reins of an empire that manages over $10 trillion in assets. His insights, strategies, and annual letters are meticulously scrutinized by investors, policymakers, and business leaders worldwide, making him one of the most influential people in the world of finance, often dubbed the "most powerful man on Wall Street."

The Genesis of a Giant: BlackRock's Founding Story

The journey of BlackRock from a nascent idea to a global financial behemoth began in 1988. Larry Fink, alongside seven visionary partners—Robert S. Kapito, Susan Wagner, Barbara Novick, Ben Golub, Hugh Frater, Ralph Schlosstein, and Keith Anderson—cofounded the firm. Their initial ambition was clear: to provide institutional clients with sophisticated asset management services, crucially from a risk management perspective. This foundational focus on understanding and mitigating risk set BlackRock apart from its contemporaries.

Under Fink's unwavering leadership, BlackRock embarked on an extraordinary growth trajectory. What started as a specialized service provider rapidly expanded its reach and capabilities, evolving into a global leader in both investment and technology solutions. The firm’s ability to adapt, innovate, and consistently deliver value to its clients, encompassing both institutional and retail investors, propelled it to an unparalleled position in the financial world. Fink’s early vision for how to really grow the firm, even musing with associates about what it would take to double BlackRock's stock price, laid the groundwork for its eventual dominance.

A Vision for the Future: Democratizing Investing and Market Prosperity

Beyond the sheer scale of BlackRock's operations, Larry Fink is a profound advocate for a particular philosophy of capital markets. In his widely read annual letters, he consistently outlines his vision for expanding these markets and, crucially, democratizing investing. Fink firmly argues that markets are an incredibly powerful system for creating prosperity, and therefore, more people should have access to them. This isn't just about financial growth; it's about fostering broader economic well-being and ensuring that the benefits of capitalism are more widely distributed.

Fink's commitment extends to addressing some of society's most pressing and often "uncomfortable topics." He has expressed how he gets energized around the necessity to openly discuss issues like social security, healthcare, and the multifaceted challenges facing global economies. This willingness to confront difficult subjects head-on, and to use BlackRock's platform to stimulate dialogue and seek solutions, underscores his role as more than just a financial executive; he is a thought leader pushing for systemic improvements and greater societal resilience.

Navigating Modern Challenges: ESG, Climate Change, and Economic Anxiety

In recent years, Larry Fink has emerged as a prominent voice in the discourse surrounding Environmental, Social, and Governance (ESG) investing and the critical issue of climate change. His views on ESG investing and climate change are not merely theoretical; they are integral to BlackRock's investment strategies and its outlook on a sustainable future. Fink frequently discusses how the energy transition, including the widespread adoption of net zero targets, will fundamentally reshape the global economy. He believes that companies that fail to adapt to these new realities risk being left behind, emphasizing that climate risk is investment risk.

Fink's annual letters serve as a crucial barometer for the financial world, typically reflecting the major business trends of the current moment. They also play a vital role in guiding and reassuring investors. For instance, BlackRock CEO Larry Fink has often used these letters to reassure investors that moments of economic anxiety will pass, offering a steady hand during turbulent times. His influence is such that when he addresses investors, as he did in his 2025 annual letter outlining the firm's direction, the entire market listens intently. His pragmatic approach to the economy, even humorously noting BlackRock "hitting the U.K. Economy with all guns blazing, provided he can find the office space," illustrates his firm's aggressive yet considered expansion and its readiness to seize opportunities globally.

The Architect of Influence: Career Highlights and Achievements

Larry Fink's career highlights are inextricably linked to the meteoric rise of BlackRock. From its humble beginnings in 1988, he has meticulously built it into the world's largest asset manager, a testament to his strategic acumen and relentless drive. Under his leadership, BlackRock has not only amassed an astonishing amount of assets under management—exceeding $10 trillion—but has also diversified its offerings, becoming a global force managing the investments of both institutional and retail investors across various asset classes and geographies.

His achievements extend beyond mere financial metrics. Fink has championed the integration of technology into investment solutions, recognizing early on the power of data and analytics in navigating complex markets. His commitment to innovation, such as the development of the Aladdin risk management platform, has ensured BlackRock remains at the forefront of the financial industry. While he may not seek the public spotlight, his quiet determination and profound impact on global capital markets have earned him the reputation as one of the most influential figures in finance, a true guru among the world's top investors.

Beyond the Headlines: Larry Fink's Enduring Impact

Despite his monumental influence, Larry Fink remains a figure who, as one German publication noted, "ist kein mann, der das rampenlicht sucht" (is not a man who seeks the spotlight). This contrasts sharply with the celebrity status of many modern business titans. Yet, his impact is undeniable. He has consistently pushed for transparency, greater access to markets, and a more sustainable financial future. Larry also got energized around how we must be able to talk about uncomfortable topics like social security, health care, and the challenges we face, demonstrating his holistic view of societal well-being tied to economic stability.

His leadership has not been without its challenges, as is inherent in managing an enterprise of BlackRock's scale and influence. However, Fink's ability to steer the firm through various economic cycles, embrace new technologies, and advocate for responsible capitalism underscores his unique position. He embodies the idea that true power in finance often resides not in personal fame, but in the quiet, consistent shaping of market dynamics and investment principles, making him a pivotal figure in understanding the modern world of finance.

Key Aspects of Larry Fink's Influence:

- **Founder & Leader of BlackRock:** Built the world's largest asset manager from scratch, now managing over $10 trillion in assets.

- **Advocate for Market Access:** Believes in democratizing investing to foster broader prosperity and societal well-being.

- **ESG & Climate Change Pioneer:** Integrates sustainability and climate risk into core investment strategies, influencing global corporate behavior.

- **Thought Leader:** His widely read annual letters set industry trends, offer economic insights, and reassure investors during uncertain times.

- **Quiet Power:** Exerts immense influence on global finance and economic policy without actively seeking personal fame or public attention.

Larry Fink's journey from co-founder of BlackRock in 1988 to its current position as the world's largest asset manager is a testament to his vision, leadership, and enduring commitment to shaping the financial landscape. He has not only built a powerhouse firm but has also profoundly influenced discussions around market access, sustainability, and economic resilience. Through his annual letters and strategic decisions, Fink continues to guide investors and corporations towards a future where capital markets serve a broader societal purpose, solidifying his legacy as an unparalleled force in global finance.

Detail Author:

- Name : Prof. Zola King DDS

- Username : steve.erdman

- Email : wisoky.lilla@gmail.com

- Birthdate : 1998-06-24

- Address : 1347 Jovani Squares South Wendellview, FL 62291-7307

- Phone : +1.801.950.6697

- Company : Mosciski-Koss

- Job : Computer-Controlled Machine Tool Operator

- Bio : Harum accusantium adipisci commodi sit et reiciendis libero. Enim aut repellendus inventore architecto facere corrupti.

Socials

linkedin:

- url : https://linkedin.com/in/aglae.hessel

- username : aglae.hessel

- bio : Officia exercitationem aperiam repellendus modi.

- followers : 4969

- following : 440

instagram:

- url : https://instagram.com/aglae_hessel

- username : aglae_hessel

- bio : Unde ut amet velit quod. Quibusdam in veniam aspernatur aspernatur similique suscipit.

- followers : 458

- following : 283

tiktok:

- url : https://tiktok.com/@hessel1985

- username : hessel1985

- bio : Excepturi quidem voluptatem sit. Sunt consectetur voluptatibus quam nulla.

- followers : 4473

- following : 2352

twitter:

- url : https://twitter.com/aglae_real

- username : aglae_real

- bio : Atque aliquam corrupti qui debitis. Commodi porro dolores rerum.

- followers : 3252

- following : 1822

facebook:

- url : https://facebook.com/aglae3284

- username : aglae3284

- bio : Laboriosam ut quia aut neque harum mollitia et et.

- followers : 3952

- following : 1782